7 Strong Warning Signs That Steady Loans May Be a High-Risk Operation in 2025

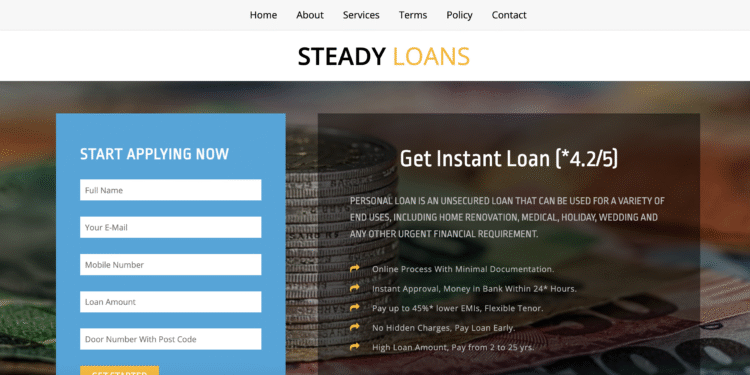

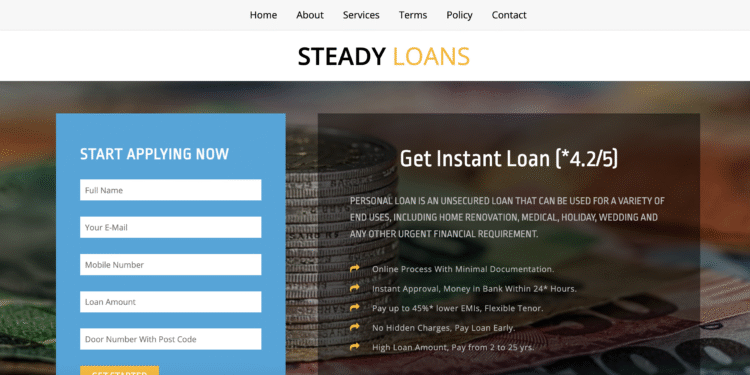

Steady Loans presents itself as a UK-based online lending or financial referral service offering quick loans or quote services. On the surface its branding appears consumer friendly. Yet a deeper inspection reveals multiple serious warning signals. These signals strongly align with operations that lead to crypto scam or fund recovery situations rather than genuine lending services. Anyone engaging with Steady Loans should proceed with extreme caution.

The first warning sign is an explicit regulator listing. The UK’s financial regulator has placed Steady Loans on its unauthorised firms warning list under the label “Clone of FCA authorised firm”. This means the regulator believes the company may be impersonating or mis-representing itself and is not authorised to provide regulated financial services in the UK. When a firm is unauthorised the protections of the Financial Ombudsman Service and the Compensation Scheme are lost. That condition puts users at significantly higher risk of loss and often forces scenarios involving crypto asset recovery rather than straightforward recourse.

The second warning sign is extremely recent domain registration and low trust ranking. According to independent website risk checkers, the domain was registered only recently and shows very low web traffic, hidden ownership details, and many red-flags like hosting on a shared server often used by fraudulent sites. A newly created website offering financial services with little verifiable history is a major risk indicator. Platforms set up this way frequently serve as short-lived funnels into scams requiring forensic tracing and crypto recovery after losses.

The third warning sign is use of “clone” tactics. The regulator warning states this firm is a clone of an authorised firm, meaning it may be copying the identity of a genuine authorised lender to mislead consumers. Clone firms are a common vehicle for scams—they borrow the credibility of a real business while operating outside regulation, increasing the likelihood of deposit misuse or withdrawal blockage and needing fund recovery.

The fourth warning sign is lack of clear lending or regulatory disclosures. Legitimate lenders in the UK provide transparent information on licence numbers, regulatory permissions, and publish clear terms on borrowing costs, repayment schedules, and consumer protection rights. In contrast Steady Loans fails to offer verifiable regulator references, and its public materials provide minimal detail about which entity holds the risk, how repayments are managed, or how borrowers are protected. That absence of transparency is often a precursor to consumer harm rather than genuine lending work.

The fifth warning sign is referral style business model with unclear fees. The website appears to function more as a lead generator or broker than a direct lender, yet it markets fast lending without clarifying how funds are processed, what intermediary may be involved, or what happens to borrower data. Such lead-generation models can channel users into high cost or unregulated lenders or expose personal data, increasing vulnerability to subsequent non-regulated offers, crypto investment push, or coercive upsell to fraudulent services that lead into crypto scam pathways.

The sixth warning sign is potential overlap with irreversible payment methods or high risk add-ons. Although not explicit, many operations of this type encourage quick funding, sometimes requiring upfront fees or complex settlement steps that lack standard consumer protections. When users are pushed to alternative payment rails or less regulated methods, the risk of loss increases and the chance of needing crypto recovery or dispute support becomes much higher.

The seventh warning sign is poor independent user review footprint. For a legitimate UK-based consumer lending business you would expect significant number of verified user reviews, independent coverage, clarifications of service quality and consumer rights. Instead the site shows minimal credible feedback, and where reviews exist many point to suspected mis-use or service issues. Lack of strong positive user evidence coupled with regulator warnings represents a major red flag. Victims of such firms often find the path forward involves formal recovery steps rather than simple customer complaint resolution.

Taken together, these seven warning signs create a compelling case that Steady Loans is significantly high risk. While none of these signs alone prove fraud, the convergence of regulator unauthorisation, cloned identity risk, minimal transparency, new domain with hidden ownership, referral-led model, potential for irreversible payments and weak independent feedback lines suggests a profile more aligned with operations requiring crypto asset recovery or fund recovery than safe consumer finance. Anyone considering using Steady Loans should treat any funds or personal data as unsafe and act only if full verification is completed. If you have already engaged the company you may need to assume risk and prepare for escalation.

Conclusion: What to Do If You Have Engaged with Steady Loans

If you have used Steady Loans, signed up, shared personal data, paid any fee, or accepted any borrowing offer, your next steps are critical. Because of the regulator’s classification and the risk profile, early action, evidence preservation, cautious interaction and potentially specialist assistance make a material difference. Below is a structured action plan for protection, escalation and if required, fund recovery.

First, preserve all evidence immediately. Take screenshots of every page you accessed: your registration confirmation, the loan or quote page, any email or chat interaction, deposit or payment receipts, terms and conditions. If you paid any amount, capture bank statements or payment provider records showing the payee details, reference numbers and timestamps. Store this material offline and duplicate it across at least two secure storages. Without verifiable documentation your ability to recover funds or escalate complaints deteriorates. This applies even though the situation may not directly involve cryptocurrency—it remains essential for any later fund recovery or data misuse claim.

Second, cease any further engagement or payments. If you’re being asked to pay an upfront fee, upgrade, or pay to unlock a loan, stop immediately. These are classic signs of loan-fee fraud where the borrower pays but the loan never materialises. The UK regulator has explicitly warned about such scams. By refusing further payments you minimise further exposure and losses.

Third, assess what you’ve shared. If personal identification documents, bank credentials or wallet information were provided, you should assume your data is compromised. Consider changing passwords, enabling two-factor authentication, monitoring your credit report and bank accounts for unusual activity. Even if there was no crypto deposit, your data may now be at risk of misuse by fraudrings.

Fourth, if funds were transferred and you suspect wrongdoing, engage a specialist. While Steady Loans may appear a consumer lending site, the clone-firm risk suggests deposit misuse or identity theft rather than legitimate service. If you used crypto or non-standard payment methods, a crypto recovery expert may help trace where funds went and whether they passed through unregulated brokers or fraud networks. Document review and forensic tracing become relevant in cases of high-risk payments.

Fifth, report your case to the relevant regulator and law-enforcement bodies. Because the firm is unauthorised, your standard recourse is limited—but reporting still matters. File a complaint with the UK regulator, provide your evidence, explain the payments made, highlight the unauthorised status. Also file a report with Action Fraud or the national cybercrime agency. Even without direct consumer protection, these reports help build a case which may trigger investigation and support other victims.

Sixth, approach your bank or payment provider and request reversal or dispute options. Explain that you believe you engaged with an unauthorised scheme or clone firm. Provide evidence and ask if your payment can be reversed, held or flagged. Banks may not guarantee recovery but early notification can increase chances of reversing suspicious transactions.

Seventh, collaborate with other affected individuals. If you can locate forums, social media groups or support communities where others share issues with Steady Loans, join them. Collective awareness drives stronger pressure, pooled evidence, and potentially class action style coordination. Clone firms often rely on volume and rotating domains; victims sharing experience help reveal the network.

Finally, use this experience to rebuild stronger protection habits. Before using any online lender next time, verify licence status via the regulator’s public register, test small amounts, avoid upfront fees for borrowing, seek clear terms and independent reviews, and treat pressure to act fast as a red flag. Prevention is the strongest defence against both traditional scams and modern crypto-scam pathways.

Steady Loans exhibits multiple red flags consistent with high-risk operations, not standard consumer lenders. If you have engaged with them assume elevated risk, document everything, halt further payments, protect your data, and if needed engage tracing or recovery professionals. Acting decisively and early is your best chance to mitigate harm.