8 Disturbing Truths About DeepSnitch.AI — The Unregistered AI-Crypto Trap Draining Investors Silently

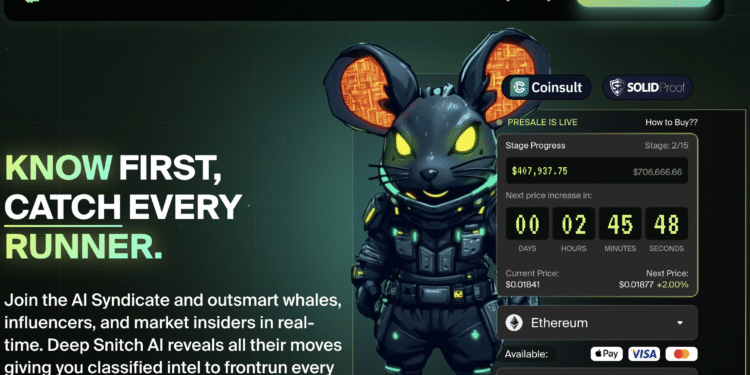

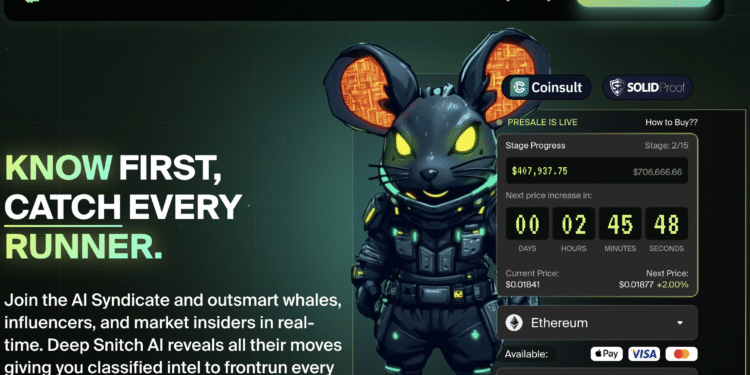

DeepSnitch.AI presents itself as a revolutionary platform that combines artificial intelligence with cryptocurrency analytics and automated trading. It claims to provide predictive market intelligence, trading optimization, and AI-driven portfolio management that allegedly outperforms human traders. The branding is slick, the technology claims sound futuristic, and the pitch is designed to appeal to traders who want to gain an edge in the volatile crypto world. However, when we examine the operational and regulatory reality behind DeepSnitch.AI, what emerges is a cluster of red flags characteristic of crypto scam operations and unregistered AI-broker hybrids. The pattern is clear: glossy claims, minimal transparency, unverified founders, and a structure that leaves investors with little hope of crypto recovery once money moves in.

RECLAIM LOST CRYPTO ASSETS HERE

The first major issue is lack of verifiable registration or licensing. DeepSnitch.AI does not appear in any recognized financial regulator’s registry. Whether it’s the FCA in the United Kingdom, the CFTC in the United States, or CySEC in Europe, no record exists linking the platform or its operators to a legally authorized trading entity. This means that DeepSnitch.AI operates entirely outside financial oversight, which immediately disqualifies it as a legitimate broker or investment platform. Any funds deposited are effectively uninsured and unprotected. This lack of regulation is the strongest indicator that DeepSnitch.AI may not be designed for long-term operation but rather to extract deposits before disappearing under another domain

Second, the AI marketing language is suspiciously vague and technically inconsistent. DeepSnitch.AI claims to use advanced neural networks, quantum-grade prediction systems, and blockchain-based validation tools, yet there is no white paper, open-source documentation, or peer-reviewed technical audit available for verification. Real AI systems require massive datasets, computational transparency, and verifiable benchmarks. None of those are presented here. The absence of technical validation coupled with over-promising performance (“up to 95% accuracy in market forecasts”) fits the familiar playbook of a crypto scam that uses buzzwords like “AI” and “machine learning” to gain trust from less-informed investors.

Third, ownership details are obscured. DeepSnitch.AI’s domain registration is hidden behind a privacy shield, and its “About Us” section provides generic names with no verifiable LinkedIn profiles, company addresses, or executive credentials. When platforms refuse to reveal their founders, it typically means they are hiding identities to evade accountability when complaints arise. This anonymity is common in crypto trading fraud schemes because it allows operators to pivot rapidly between domains, operating new clones once reputational damage mounts.

Fourth, multiple independent scam reporting sites and online forums have begun flagging DeepSnitch.AI as suspicious. Users have reported deposit issues, unresponsive customer support, and blocked withdrawals once initial profits appear. Many mention that the system shows growing account balances that cannot actually be withdrawn — a textbook hallmark of unregistered brokers simulating profit to build user confidence. When victims try to cash out, the platform either invents “compliance verification” costs or simply stops responding. These tactics mirror those used by dozens of crypto recovery targets investigated globally in 2024–2025.

Fifth, DeepSnitch.AI’s terms of service contain troubling clauses. Hidden in fine print are statements that the company “reserves the right to modify account balances,” that users “agree to non-refundable service fees,” and that all decisions made by the platform’s automated systems are “final and binding.” Such clauses effectively strip users of legal recourse and give the operator unlimited power to confiscate balances. Legitimate brokers and AI analytics providers never include such predatory clauses. This legal framing further proves the operation is designed to insulate the operator, not the user.

Sixth, the social media footprint of DeepSnitch.AI is artificial. Most follower accounts are newly created, profile photos are recycled or AI-generated, and engagement metrics are low or bot-like. The absence of credible third-party endorsements, real partnerships, or reviews from recognized analysts underscores the likelihood of manufactured credibility. Genuine AI-crypto platforms typically collaborate with exchanges, research institutes, or fintech accelerators. DeepSnitch.AI shows none of that.

Seventh, technical traces show domain irregularities. The site is hosted on shared servers alongside other flagged financial domains and uses temporary-grade SSL certificates — both indicators of short-term deployment. This aligns with the operational pattern of crypto scam networks that recycle domains to evade regulators and victims. If DeepSnitch.AI shuts down tomorrow, investors will struggle to locate operators or reclaim funds.

Finally, crypto recovery from such platforms is extremely difficult. Once assets are deposited via blockchain transactions, there are no chargeback mechanisms. Victims often face complex cross-border tracing, requiring digital forensics experts, legal filings, and time-intensive investigations. Even with expert assistance, success is rare and usually partial. The combination of anonymity, jurisdictional ambiguity, and untraceable fund flows makes DeepSnitch.AI a perfect storm for investor loss.

CLICK HERE TO GET YOUR MONEY BACK

Conclusion

DeepSnitch.AI embodies nearly every risk signal an investor should recognize before engaging in any online trading or AI-crypto venture. Its unverified AI claims, lack of licensing, hidden ownership, and early user complaints form a comprehensive picture of an operation that thrives on deception and opacity. This platform leverages the current AI hype to cloak a crypto trading fraud mechanism in technological glamour. The fact that it presents itself as an intelligent trading solution without any third-party validation or regulation means investors have no meaningful way to confirm that trades are real or that deposits are used legitimately.

In financial technology, credibility is built on transparency, verifiable partnerships, and compliance oversight. DeepSnitch.AI has none of those pillars. Without regulatory oversight, it can manipulate trading data, alter user dashboards, or fabricate profits. Victims often realize too late that the “AI” component is simply a façade — an automated interface showing manipulated performance numbers while operators quietly siphon deposited funds.

The use of privacy-protected registration and fabricated team credentials removes any accountability trail. This absence of transparency ensures that even when problems surface, victims have nowhere to turn. Law enforcement typically requires identifiable corporate officers, physical addresses, and transactional evidence — none of which DeepSnitch.AI provides. Thus, even in the best-case scenario, pursuing crypto recovery from this platform becomes an uphill legal maze.

The rise of AI-labeled scams in 2025 mirrors the earlier waves of DeFi and NFT fraud in previous years. Scammers adapt their narratives to the latest buzzwords, using them to legitimize operations in the eyes of less technical investors. DeepSnitch.AI’s design fits this evolution perfectly: a blend of impressive graphics, futuristic wording, and manipulative social proof that conceals a fundamentally unregulated operation.

If you have already interacted with DeepSnitch.AI, immediate defensive actions are vital. Secure your remaining funds, preserve every email and chat transcript, and export all wallet or transaction IDs linked to your deposits. Contact your financial institution or card issuer to report potential fraud. Consult with professional crypto recovery services that specialize in tracing transactions and compiling evidence for law enforcement. While full reimbursement is rare, early reporting significantly improves the odds of partial recovery or future restitution if law enforcement actions occur.

The strongest defense, however, remains prevention. Never assume that AI-enhanced performance or futuristic branding equals legitimacy. Always verify registration numbers with regulators, demand clear proof of technical audits, and check whether the company’s leadership has verifiable digital footprints. Projects that hide their operators or overpromise performance almost always turn out to be dangerous.

In summary, DeepSnitch.AI is an unregistered, opaque, and high-risk platform that exploits AI and crypto hype to attract deposits. Its combination of anonymity, unverifiable technology, and regulatory absence makes it indistinguishable from a crypto scam. Until proven otherwise by transparent audits and legitimate registration, it should be avoided completely. Protect your funds, stay informed, and remember that no artificial intelligence can predict the market well enough to eliminate risk — but human vigilance can prevent you from becoming the next victim.

TO GET YOUR CRYPTO BACK, CLICK HERE